Over the past three months we've heard warnings and threats from the big US credit agencies Moody's Investor Services, Standard & Poors's, and Fitch Ratings that the U.S. is on a negative credit watch and may have its AAA credit rating downgraded. Today, a Chinese credit agency Dagong Global Credit Rating took it a step further and actually downgraded U.S. debt. That's the second downgrade from this agency in the past year. All of these credit agencies are often a dollar short and a day late in spotting financial difficulty and have about 0 credibility rating risk. They are after all the same agencies that primed the pump for the global financial crisis, by giving investment grade credit ratings to absolutely awful mortgage backed securities. Indeed, if the rating agencies hadn't been at worst complicit, and at best asleep at the wheel, the mortgage bubble and collapse could not have happened. The Financial Crisis Inquiry Commission reported in 2012 that:

"The three credit rating agencies were key enablers of the financial meltdown. The mortgage-related securities at the heart of the crisis could not have been marketed and sold without their seal of approval. Investors relied on them, often blindly. In some cases, they were obligated to use them, or regulatory capital standards were hinged on them. This crisis could not have happened without the rating agencies. Their ratings helped the market soar and their downgrades through 2007 and 2008 wreaked havoc across markets and firms."

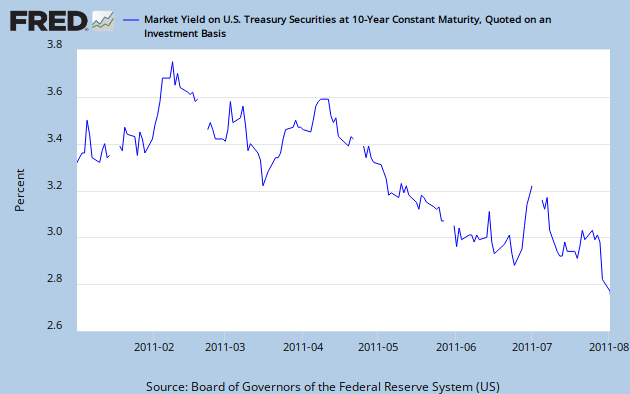

So now that they totally missed the boat on the biggest financial bubble in our generation, they are trying to regain some credibility by rattling the saber about US debt and US bonds. The problem is, no one is buying what they are saying. Even as the rating agencies have threatened, yields have come down (yields generally go up when the risk of default climbs or a bond is downgraded). For example, 10 year Treasury yields have come down since January 2011.

The same is true of Dagong Global Credit Rating. Dagong stated in its downgrade that it believes that the U.S. Government can't be relied upon to compromise and act efficiently in times economic need. Of course, to the Chinese who are used to central control the U.S. system looks chaotic. But what happened over the past week was true democracy in action. Different politicans representing their constituents fought, battled, and eventually reached a compromise. No one said it would be easy and tough times remain, but the reality is, the U.S. is now taking action to solve its debt problems rather than pushing them off for the future. And the Chinese couldn't be expected to understand this process.

The time to downgrade U.S. debt has come and gone. It should have happened when Social Security and Medicare were considered untouchable. Now that politicians are getting brave enough to discuss entitlement reform, the long-term economic picture looks much better. Bond market investors seem to understand that.

So, ignore the headline grabbing pronouoncements from the credit rating agencies and focus on the big picture. Is the U.S. moving to reign in its spending and begin growing again? Are yields on government securities going up, staying flat, or even going down? Is the economy growing again or falling back into a recession? How is the rest of the world doing versus the U.S.?

Comments

Arthur

August 04, 2011

The rating agencies did indeed blow it with the subprime crisis because they were being paid by the banks. They were profiting from the ratings. Such a dynamic does not exist with government bonds and the rating agencies have done a pretty good job of watching government and municipal debt over the years.

Is this review helpful? Yes:0 / No: 2

Liam Peterson

August 04, 2011

Good article. I agree that the credibility of the rating agencies has been totally destroyed. It's hard to believe anything that comes out of Wall Street because it always feels like the news and information is being gamed. How else would some people billions while the rest of us get the crumbs?

Is this review helpful? Yes:0 / No: 1

Add your Comment

or use your BestCashCow account